The Long Tail

I’m finally catching up with my reading and would like to share some concepts from the book “The Long Tail” by Chris Anderson that I found quite fascinating. Note that Chris Anderson is editor in chief of Wired, one my absolute favorite magazines. This topic has been blogged to death. However, most people I have spoken to recently have never heard of this so I feel compelled to provide a brief summary since it is a very critical concept for today's economy.

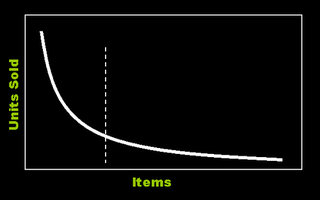

The key premise of “The Long Tail” is that the economy is shifting away from hits to niches. In the past, if something was not a hit, it was essentially considered a market failure since non-hits did not have any economic viability. When products were predominantly sold in physical bricks and mortar stores, the cost to keep an item on a shelf was such that it has to sell very well in order to justify the expense. If you were a musician and your CD was not expected to be a huge seller, it was not carried by music stores and you essentially sold nothing. Labels only heavily promoted bands they thought would make it and the rest were left out in the cold. In effect the labels and stores were the filter essentially deciding for you what is good and what is bad.

However, with the advent of the internet, the cost to make a product available to the public dropped significantly. This cost can approach $0 for electronic content like music. For physical products like books, storing items in a warehouse is much cheaper than shelf space at your local books store. Amazon can therefore make money even on items that don’t sell in large volumes. As people now had access to a much greater variety of products, purchasing patterns changed significantly. Although hits and top brands still exist, people are spending much more money on non-hits or niches.

You can see evidence of this everywhere. Take television as an example. Not so many years ago, there were only a few TV channels and no internet. Everyone essentially watched the same shows. Fast forward to the present and the number of niche cable channels is incredible. Each individual niche by itself may not be a huge power by itself but if you take them all together, the revenue is significant compared to the top channels such as NBC, CBS, ABC, CBC (ha ha ha). In many industries, selling many niches is more lucrative than selling a few hits. As Chris puts it, “Why the Future of Business is Selling Less of More”.

class="MsoNormal">

But … there’s more. Simply providing choice is not enough. It can be overwhelming and may turn customers away. The real magic comes from helping the customer find what he wants effectively and efficiently. If you ever travel and need to book a hotel somewhere, your first stop should be trip advisor http://www.tripadvisor.com or other sites like it. Travelers share their experience and rate the hotels allowing you to make an informed decision. Google is the ultimate success story in this space. The founders realized years ago that people would value a tool that lets them find what they need fast. I use Google at least 20 times a day … I can’t image surfing the net without it.

So the summary is …. there is huge opportunity in niches but you have to provide people the tools to find what they need. Jeff Bezos (founder of Amazon), Brin and Page (founders of Google) figured this out long before most of us and as a result are ridiculously rich.

I’ve only scratched the surface here. I strongly recommend you get you hands on the book (got mine in three days from Amazon) and/or check out www.thelongtail.com. In my next post, I will touch on the impact of this market transition on my own startup concepts.

1 Comments:

It all essentially leads to the same business principle...build a better mouse-trap and the world will beat a path to your door(Ralph Waldo Emerson)!!! No matter what line of business you choose, the same principle will always apply.

4:18 AM

Post a Comment

<< Home